FRESH AIR

Wait, what? West Bank settlements mired in massive housing slump

July 20, 2023 | Ahron Shapiro

While it may sound surprising and counterintuitive, the numbers don’t lie: Despite recent well-publicised efforts by key right-wing legislators in Israel’s Government coalition – – such as Finance Minister and Minister in the Defense Ministry Betzalel Smotrich of the Religious Zionism party – to remove some of the red tape involved in approving new housing in Israel’s West Bank settlements, both sales of new housing and actual housing starts in the West Bank have plummeted in recent months. This is primarily due to faltering demand, driven in part by high interest rates.

Remarkably, housing starts in the settlements over the past half year have slowed so dramatically that, should the phenomenon continue, we are on track to potentially see the smallest number of settlement housing starts in any 12-month period since Israel instituted a unilateral ten-month settlement freeze back in 2010.

This reality is readily apparent in both a July 17 report in Israel’s popular Hebrew daily Yedioth Ahronoth, and recent data released by Israel’s Central Bureau of Statistics (CBS).

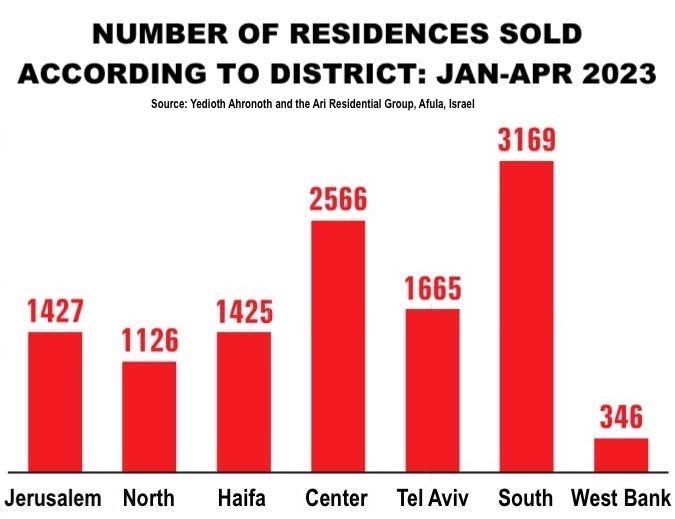

The article in Yedioth Ahronoth – which actually focused on surging housing sales in Israel’s southern district and only mentions the lagging West Bank housing sales in passing – revealed that a scant 346 new residences were sold in the settlements between January and April 2023 – a drop of 60% compared to the same period in 2022.

Meanwhile, on June 20, the CBS released its latest statistics of new housing starts and completions nationwide, together with a more comprehensive media release (Hebrew only) that dived deeper into the stats. This report showed that in the first quarter of 2023, construction started on only 249 housing units in Israel’s West Bank settlements. This is not only a drop of 61% compared to the first quarter of the previous year, but also continued the trend that began in Q4 2022, which recorded 71% fewer housing starts than Q4 2021.

Should the trend over the last two quarters repeat themselves over the next two quarters, this would average out to 1042 units for the year (Q4 2022 to Q4 2023). This would be even lower than 2011, when Israel recorded only 1,088 housing starts in all of its West Bank settlements.

According to the media release, the number of new housing permits issued for construction in Israel’s West Bank settlements plummeted 24.43% (from 3,172 to 2,397) overall between April 2022 and March 2023, compared to the previous 12-month period. This was, by far, the largest drop percentage-wise in new housing permits issued in any district of Israel – proportionally more than double the drop registered in either Tel Aviv or Haifa, for example (while in contrast, Israel’s northern and southern peripheral towns saw substantial increases over the same period).

On July 13, the CBS released sales data of new housing units in the West Bank (in a Hebrew language press release): The latest three-month period (March 2023- May 2023) saw 215 units sold, compared to 219 in the previous three months, a decrease of 1.8%.

Further down in the same report, it is revealed that almost 2,300 new homes or apartments are available for sale in the settlements but, as the sales figures show, the vast majority are simply not selling. It’s not clear from the report what stage of construction these unsold units are in, or if they are simply being marketed “off the plan” and may not get built at all if they are not financed by a buyer ahead of time.

At any rate, those nearly 2,300 unsold units represent just 4% of all available new housing stock in the country.

Indeed, by this and any other recent metric, settlement housing starts and sales figures, and unsold housing reserves, are proportionally weak vis-à-vis the size of the settler population.

According to Yedioth Ahronoth, only 2.95% of new housing sales in Israel in the first four months of this year were in the settlements, while the CBS’ June 20 media release notes that housing starts in Israel’s West Bank settlements between April 2022 and March 2023 represented only 3.5% of the housing starts nationwide.

Since approximately 5.2% of Israelis live in West Bank settlements (notably, about 71% of them live in five settlement blocs that would likely remain part of Israel in any future two-state outcome after mutually agreed land swaps), this also means that there were 43% fewer sales of new housing in the West Bank in the first four months of 2023 than might be expected, given the settler share of Israel’s total population.

What’s slowing the market?

The Yedioth Ahronoth article makes clear that high interest rates are slowing housing sales in most of the country – but interestingly, not all of it. As mentioned briefly above, districts on Israel’s northern and southern periphery have bucked the trend and are continuing to see sales growth, since new homes in these areas are priced lower than similar properties in Israel’s cities and central plain, and in West Bank settlements – – most of which are within easy commuting range to Israel’s largest cities and have become relatively expensive.

In any event, Israeli real estate experts say the economic conditions fueling the housing slowdown are unlikely to improve significantly anytime soon.

Thus, while there is little doubt that elements in the current Government are pushing policies intended to encourage settlement growth, there is no evidence these policies are having the desired effect, given interest rates and other factors are pushing strongly in the opposite direction.

Tags: Israel, Palestinians, settlements

RELATED ARTICLES

US Middle East strategy amid regional instability: Dana Stroul at the Sydney Institute

Antisemitism in Australia after the Bondi Massacre: Arsen Ostrovsky at the Sydney Institute