FRESH AIR

UPDATES

Israel’s gas deal at risk?

April 1, 2016 | Sharyn Mittelman

Israel’s gas finds in the East Mediterranean could set the stage for the Jewish State to become a regional energy powerhouse, creating new strategic and economic opportunities. However, following an Israeli Supreme Court ruling, that potential appears at risk.

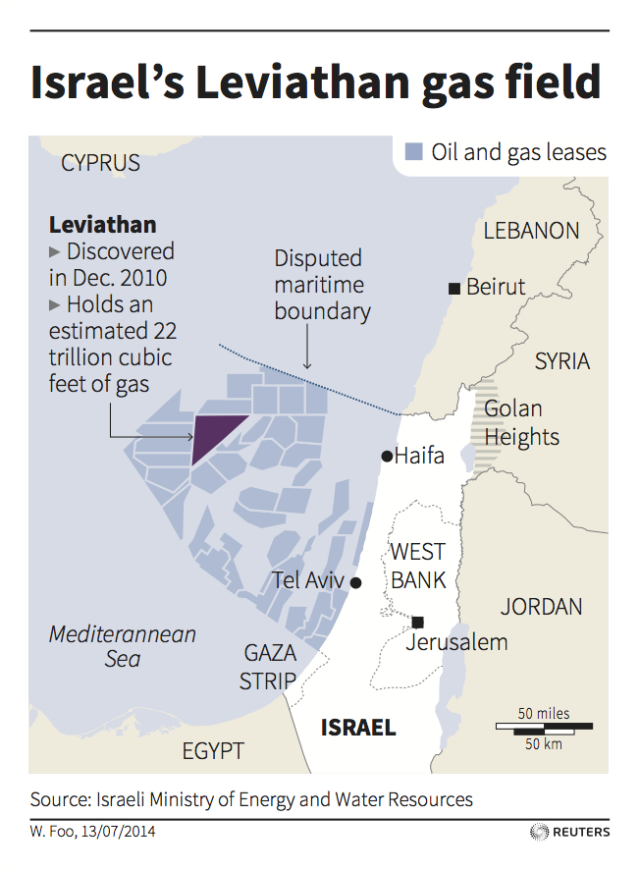

On March 27 Israel’s highest court struck down a deal made between the Israeli government, US based company Noble Energy and Israeli partner Delek Group in December to develop and export the Leviathan gas field, discovered in 2010 and one of largest gas fields in the eastern Mediterranean. While the court recognised that natural gas development is a matter of strategic national interest for Israel, four out of five judges found that a key component of the contract known as the “stability clause”, barring future Israeli governments from altering the terms of the agreement for ten years, was unconstitutional. The stability clause would protect the plan from regulatory changes in taxation, antitrust limitations and export quotas. Delek and Noble had argued that the stability clause was necessary to facilitate the billions in investment to develop the Leviathan. In its decision, the court ruled that the deal should be suspended for a year and required the government to amend or cancel the stability clause.

The development of Israel’s gas fields has been a story of repeated regulatory setbacks. Around 1,400 billion cubic metres of natural gas lie offshore in the Tamar, Leviathan, Tanin and Karish fields. Noble Energy invested millions in discovering the Tamar field, and today around 40 percent of Israel’s electricity production is fueled by natural gas from Tamar. However, issues surfaced when environmental groups blocked construction of a main natural gas receiving facility and forced its relocation. In another setback, following regulatory changes to the gas sector in Israel, in 2014 Australian company Woodside Petroleum withdrew its interest in partnering with Israel or Noble to develop Leviathan. Then in late 2014, Israel’s regulator decided that the plan to develop the Leviathan field by Noble and Delek was anti-competitive. To sidestep the regulator’s decision, in December 2015 Prime Minister Benjamin Netanyahu signed off on the deal that invoked a clause in antitrust legislation to force the arrangement through on grounds of national security. In response, a group of organisations including Movement for the Quality of Government, the Israel Union for Environmental Defense, and the Labor and Meretz parties filed a petition in the Supreme Court that objected to the plans to circumvent the regulator. In February, Netanyahu appeared before the court to defend his move, a first for a sitting prime minister.

Developing Israel’s gas fields has the potential to enable Israel to strengthen its diplomatic and economic ties with its neighbours, especially Jordan, Egypt, Cyprus, Turkey and Greece. However, despite the potential gains, the gas deal has been controversial within Israel.Thousands of Israelis have protested the deal – arguing that it benefits big corporations at the expense of ordinary Israelis as it will offer Israeli consumers uncompetitive pricing, and will send too much gas outside of Israel, which may become an energy-security risk (see previous blog post).

Netanyahu was bitterly disappointed by the court’s decision and stated, “The supreme court’s resolution severely threatens the development of Israel’s gas reserves. Israel is seen as a country with exaggerated legal interference that makes doing business hard,” adding “We will seek alternative ways to overcome the serious harm inflicted on Israel’s economy by this hard to understand resolution.” In contrast, Israeli Opposition leader Isaac Herzog whose Zionist Union Knesset faction had filed the petition against the deal welcomed the court’s decision as “correct and courageous”.

Two days after the court ruling, Israel’s Energy Minister Yuval Steinitz began the process of trying to meet the court’s objections regarding the stability clause, and was optimistic that the work could be completed quickly, telling Reuters, “I think it will take a few weeks or maximum a couple of months.” On March 29, Steinitz met with Delek and Noble Energy and discussed three possible solutions, according to Haaretz:

“The first would be to legislate the stability clause or enact a broader law empowering the government to make such a concession in large infrastructure projects. Another option is to amend the stability clause. ‘We keep the right to make changes, but if this government or the next government will make significant changes, then [the companies] will be able to ask for compensation,’ Steinitz said. A third option is a ‘self-safety network’ that could be a government commitment to the companies to buy a certain amount of gas at a minimum price to ensure they can repay their debts.”

Despite the Israeli government’s commitment to rectify the issue and ensure the gas deal sticks, many are concerned that regulatory burdens plaguing the development of Israel’s gas reserves will be to the detriment of its national interests. For example, David Weinberg wrote in Israel Hayom:

“My main concern here isn’t the public-corporate-constitutional side of the dispute. Perhaps Noble and the government can yet work things out, again; although it won’t be easy with an emboldened Knesset opposition nipping at Netanyahu’s heels.

What is of even greater concern is international perceptions of Israel as a stable business environment. At stake is Israel’s global reputation as a reliable place to make money. Without that, foreign direct investment (FDI) in Israel will crash. Investors are scared away from places afflicted by extreme over-regulation, confused policymaking, constantly-changing tax rules, splenetic politicians, and over-ambitious judges.

Furthermore, if this country continues to muck around in internal disputes over the gas sector, Israel will fritter way the diplomatic and strategic opportunities offered by the gas finds.

Gas must be considered a fundamental security issue. Israel already has agreements to sell Jordan enough gas for almost all of its electricity production; a diplomatic coup that helps solidify a vital security partnership with the Hashemite Kingdom.

Cyprus wants to partner with Israel in selling massive amounts of gas to the Egyptians; something that would help stabilize the Sisi regime. Greece, and even Turkey, want Israeli natural gas pipelines or liquid natural gas shipments to run through their countries. Russia’s national giant, Gazprom, is also seeking partnership with Israel.

In other words, Israel’s natural gas sector presents a unique opportunity for partnership between local and foreign companies, between government and the corporate sector, between Israel and its Arab and Mediterranean neighbors, between Israel and Europe, and even between Israel and Asia. Natural gas can be an Israeli strategic geopolitical tool of the highest order. But not if Israel acts with inconsistency, short-sightedness and never-ending legal wrangling.”

Moreover, Simon Henderson of the Washington Institute writes that the Supreme Court’s decision could hamper foreign investment in Israel and could lead Noble to seek a punitive arbitration award against Israel of up to US$12 billion. Henderson also notes that Israel’s neighbours in the Mediterranean have also found their own gas reserves, while others seek partnerships:

“In Cyprus, Noble discovered the Aphrodite field, which lies mainly in the island’s exclusive economic zone and stretches partly into Israel’s EEZ as well. Cypriot officials are currently trying to attract more companies to drill there. And last year the Italian conglomerate Eni found the Zohr field in Egypt’s EEZ; even bigger than Leviathan, it lies only three miles from Egypt’s maritime border with Cyprus. Various actors have drawn up elaborate schemes for Israel, Cyprus, Egypt, and Greece to cooperate in using and exporting this gas. Even Turkey, currentlyreliant on expensive Russian, Iranian, and Azerbaijani gas, had contemplated buying Israeli supplies — a commercial decision that would require political rapprochement with both Jerusalem and Cyprus, and which may be further complicated by the latest court judgement.”

Given that some of Israel’s neighbours have found their own large gas deposits, for Israel to reap the optimum economic and strategic rewards from its gas fields, time is of the essence. Israel has the potential to be a significant energy exporter to Europe, Asia and its Arab neighbours, discussions between Greece and Cyprus have already taken place to examine a joint pipeline, while Turkey has sought to mend its relationship with Israel, which many speculate is partly due to Israel’s gas finds (see earlier blog post). However, these promising developments have the potential to turn into missed opportunities if the gas issue is used as “political football”, and if an Israeli consensus cannot be reached. The Israeli government will need to work constructively and creatively with opposition parties and with invested companies to make certain that Israel is a destination of choice for business investment, while also ensuring that the strategic opportunities of the gas fields are not squandered.

Sharyn Mittelman

Tags: Israel

RELATED ARTICLES

US Middle East strategy amid regional instability: Dana Stroul at the Sydney Institute

Antisemitism in Australia after the Bondi Massacre: Arsen Ostrovsky at the Sydney Institute